As An Alternative, they buy and maintain belongings for years, even many years, permitting compound growth to work of their favor. This approach is well-liked as a outcome of it minimizes charges, reduces danger, and removes the stress of portfolio management. Sure, you’ll find a way to mix passive and active investing strategies, similar to pros and cons of active investing by owning some passive funds and some lively funds. You would possibly accomplish that by selecting passive for some types of belongings like shares while active for property like bonds. In basic, active investing prices greater than passive as a result of components corresponding to higher fund administration fees, buying and selling fees, and taxable events.

This mix provides the advantages of passive investing whereas permitting room for strategic changes when opportunities arise. At it’s core, energetic investing vs. passive investing comes all the means down to how involved you need to be in managing your portfolio. Other investors choose a hands-off approach that lets their investments develop steadily over time.

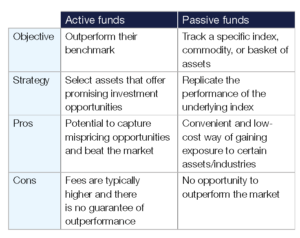

- Passive investing aims to replicate the performance of a market index rather than attempting to outperform it.

- These lower prices are one other issue in the better returns for passive buyers.

- Discover why so many clients choose us, and what makes us a world-leading provider of CFDs.

- The worth of investments will fluctuate, which will trigger prices to fall as well as rise and you may not get again the unique quantity you invested.

Think About each an ETF and an active fund begin with €100,000, and the market returns 7% in a year. Passively managed investments can offer more flexibility as life situations change. This is especially essential for servicemembers who may face deployments or relocations. Servicemembers additionally might desire a steady earnings from passive investments during deployments or after retirement. Energetic investing provides the possibility for nice returns, nevertheless it additionally requires extra hands-on administration and comes with larger risks. Energetic investing appeals to individuals who wish to proactively handle their investment portfolios.

Typically, exchange-traded funds (ETFs) are passive funding automobiles, but not all are, so it is important to rigorously contemplate the fund’s strategy. In contrast to energetic funds, passively managed funds look to intently track the performance of a particular market benchmark or index. The common narrative that passive investing will overtake lively management suggests a primarily passive future for buyers. However, an analysis of fund AUM data across time and regions presents a starkly different perspective on the future of investment management. Even energetic fund managers whose job is to outperform the market, not often outperform the market. It Is Proof of personhood unlikely that an novice investor, with fewer sources and less time, will do higher.

Faqs About Passive Investing Vs Energetic Investing

This could influence which products we review and write about (and the place these products appear on the site), but it on no account impacts our recommendations or recommendation, which are grounded in thousands of hours of analysis. Our companions cannot pay us to guarantee favorable evaluations of their products or services. This could also be particularly worrisome for these who don’t wish to spend money on sure companies with poor ethical values or negative impacts on the setting.

Prices And Risks Related To Active Investing

The views expressed here shouldn’t be taken as a advice, advice or forecast. If you’re uncertain about the suitability of an funding, please converse to a financial adviser. Chase’s web site and/or cellular phrases, privacy and security policies don’t apply to the positioning or app you are about to go to.

Case Research From Switzerland: Successes And Setbacks

This is in contrast to, for instance, the crypto house, the place the value of a currency or token is usually determined by its potential quite than by concrete applications. The info https://www.xcritical.com/ on this web site doesn’t comprise (and shouldn’t be construed as containing) investment advice or an investment suggestion, or a proposal of or solicitation for transaction in any financial instrument. It’s additionally price noting that an energetic investor who underperforms a passive investor in nine out of ten years can still beat their performance if the tenth year brings exceptional returns. Lively bond managers had been hit hardest from June 2024 to June 2025. Across the three fixed-income classes included in the research, success rates plummeted 31 share points to 31% for the 12 months by way of June 2025. Active intermediate-core bond managers led the cohort with a 52% success rate, whereas active corporate-bond managers noticed a paltry 4% success price.

Market situations can change incessantly, and whether or not a bull or bear market prevails can considerably affect investment strategies. The trading technique that may probably work higher for you relies upon a lot on how much time you wish to devote to investing, and albeit, whether or not you need the best odds of success over time. The presents that seem on this site are from corporations that compensate us. However this compensation doesn’t influence the knowledge we publish, or the critiques that you simply see on this website.

They would possibly interact in energetic buying and selling vs. long-term investing, hypothesis, or rely on professional fund managers through lively vs. passive fund administration. Lively investing is when you attempt to beat the market’s average returns by actively buying and promoting investments, quite than merely holding them long-term. Assume of it like being a chef who’s continually tweaking their menu versus someone who sticks to tried-and-true recipes. Active buyers frequently purchase and promote shares, bonds, or other investments.